So.. you're ready to buy a home and you want to know what to expect?

Considering the idea of buying a home but not really certain how or where to get started is the MOST common comment I get.

TBH

I get it...

Lets try and make the process a little easier to digest.

Hows that sound?

SO

Lets make a quick comparison.

Hear me out, But..

Buying a home is like taking a Road trip!

🚙🚙🚙

🌟 You Need good travel Buddies

(realtor & lender)

🌟 A road map to get to your destination

(loan process & strategy to get you your HOME)

&

🌟 A vehicle to get there

(a mortgage is like a vehicle/tool that you get to utilize to get you to your destination)

"The quality of good company quote"

If I have heard it once I can promise I have heard it 100 times before- you are not in this alone and trust me it's not that hard as it seems- or at least it doesn't have to be if you're working with the right team (TRAVEL BUDDIES)!

The last thing you want, when preparing to embark in what's about to be a monumental moment in your life! Also to add, financially the biggest decision you can make! Not to freak you out, but; WHO you are working with is kindaaaaa important!

🪩🕺🏿🪩🕺🏼🪩

There are two team players that you want to choose wisely to have on YOUR team when buying a home. BUT be WARNED!! As soon as you mention the idea you will most definitely get a few referrals one from your friends maybe someone's cousin who may or may not actually have sold a home in the past 5 years but “STILL LICENSED” and your mom surely has a friend who she plays tennis with who definitely has been doing this for 100 years- sigh….

SO make sure you are working with an ACTIVE professional!

P.S.

dont have a realtor that you know, like & trust?

Lucky you!!

I've got friends across the country!! I'm sure I can get you in contact with someone who would be THRILLED to work with you!

🫶🏼

SO, as I was saying!

Once you identify your first travel buddy- Your Realtor, You also need to choose your other travel companion wisely~

SO-we need to circle back to the money…

Hii

I'm Geneva Dean (The Mortgage Momma) and I'm here to help you secure financing with ease. My 14 years of industry experience speaks for itself from starting in Credit repair to owning a Mortgage Brokerage you can not ask for a more seasoned Loan Officer who take pride in educating homebuyers and helping them achieve their financial goals. I have turned more first time homebuyers into investors over the years and have the resources to shop hundreds of banks to help structure not only the most customized loan option for you but also affordable!

🪩🪩🪩

SO there you have it! Between myself and your Epic Realtor you have your powerhouse team who has the resources and connections to make sure your home buying experience a breeze. We will lighten the load and make this an enjoyable experience!

SO now that you have Travel Buddies! what's next?

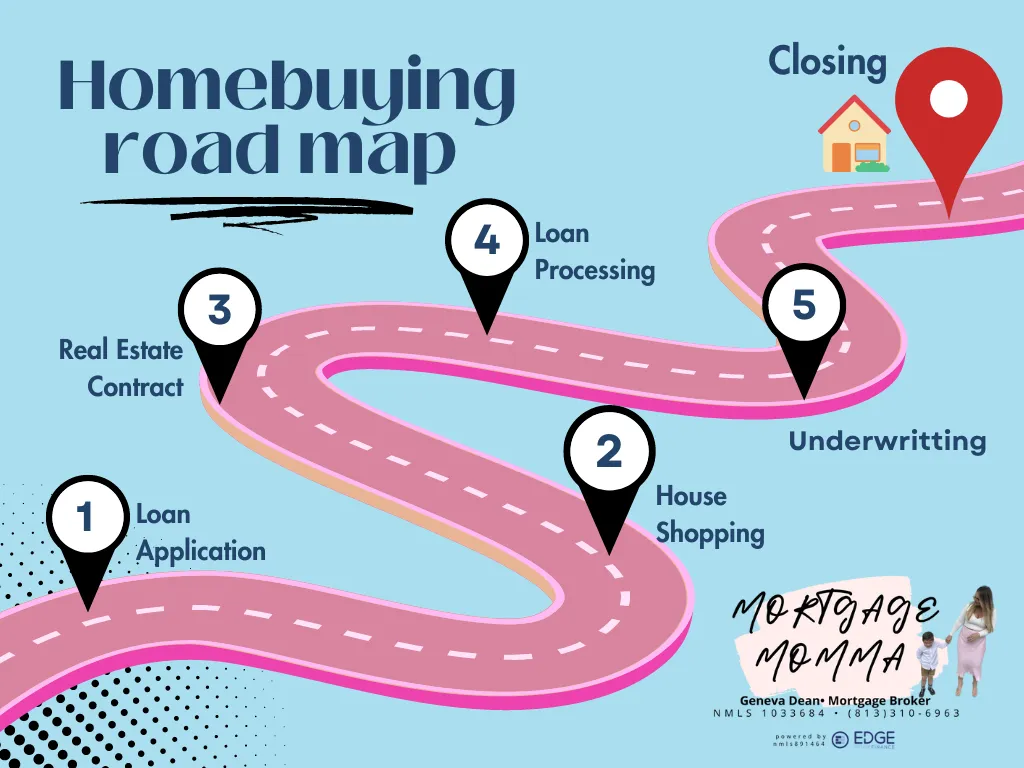

Lets look at the roadmap to see where were headed.

🚙🚙🚙

Now that we have an idea of where were headed, Lets take a closer look at our directions to Homeownership.

Step 1: Loan application

First things first- we need to get you Pre-Approved (MORTGAGE LINGO from the link above) so you can set a housing budget that you are BOTH comfortable with and set your approval parameters.

SO I mentioned previously that we need to consider our loan to be like a vehicle for the home buying process.

Your mortgage is a tool that is going to allow you to obtain the asset (home) that you desire to purchase.

One special thing about me is that I work with over 100 lenders/banks and EACH of them offer 2-5 loan options at the least.

Interested in more info about the Loan Application itself before diving in?

Say it with me,

We like options!

Options are going to allow us to make sure we have the best loan product (vehicle) that best fits YOUR needs to get you to your destination (homeownership).

Step 2: House Shopping

This is the fun part!

After you become the proud recipient of your Pre-Approval letter you officially have your authority to shop for a home and you are prepared to write an offer! Now is the time to meet with your Realtor and discuss what your needs and wants are in your home purchase.

Found what you're looking for?

Step 3: Real Estate Contract

Your Realtor will be a pro in making sure that your offer gets accepted, especially in multiple offer scenarios.

Want to run numbers on the home you're interested in? Although this is not an official step in the home buying process this is where the nerves start to kick in and you will want to understand what the reality of what buying this home looks like.

Having an idea of what the numbers look like will help ease your mind. You will have access to Geneva’s mortgage calculator that you can adjust in real time to estimate what your closing costs will look like and your mortgage payment. We can even update the taxes to reflect what the County Appraiser is quoting so you can have property specific details.

What do the numbers look like?

After you signed the contract and wait to hear from the Seller- no news is good news! Rest assured that your Home Buying Power Team is at work for you!

✨✨✨

We are certain (especially in this market) to reach out to the listing agent to confirm how awesome of a homebuyer you are and how legitimate your Pre-Approval is.

✨✨✨

And just like that... Offer Accepted!

✨✨✨

Me and my team will be in touch within 24 hours to review your Loan Disclosures with you.

Your Realtor will be in touch to go over the details for your escrow deposit and to coordinate your home inspection.

This would be a GREAT time to read up on the Mortgage Lingo and the Do's and Don'ts of the home buying process to make sure you don't feel like you need a financial interpreter or make any avoidable mistake in the home buying process!

✨✨✨

The first few days of going under contract are definitely the busiest so plan accordingly. There will be several things for you sign initial and date from both your Realtor and Mortgage Broker. You may also need to be available to take a few calls and gather some documentation.

Step 5: Loan in Process

So right about this time in process you and I accompanied with my amazing Lending Team will become BFFs. After your Loan Disclosures have been signed, your requested documents sent to me and my ROCKSTAR mortgage team works their magic your loan will go through two steps- Processing and underwriting.

Processing-

This is where they order all their “services” for your loan, like verify taxes and income with the IRS as well as your employer. Review your assets and make sure there aren't any red flags for the underwriter and if there is anything that could be “questioned” THEN the processor works to provide documents to further explain the situation.

Basically our Loan Processor takes all your financial documents and makes a story about your qualification and she checks all the boxes to verify that our story makes sense.

THEN your loan is zipped over to the underwriter who is the decision maker on your loan. SINCE it's RARE that we have the appraisal back in this short time as well as finalized “services” that our processor just ordered- we will most likely get a Conditional Approval. Which brings up to the next step.

Step 6: Underwritting

This is great news- it means your loan looks great and based on a few outstanding conditions they will offer a Loan Approval.

Your Loan is back in the processors hands and there your processor will work on filling these final conditions. These are normally pretty easy peasy things like waiting for the IRS to verify the tax record, finalizing homeowners insurance, and verifying closing documents with the title company.

Once our processor checks these final boxes and the loan is sent back to the underwriter one last time for FINAL approval and we get the best new- Clear to Close!

Step 7: Closing time

"Alexa play closing time by Semisonic."

So we got the best news your loan is cleared to close- what does that mean?

Well... You got the loan!

Everything checked out and after the lender and title company finish balancing the invoices the lender will send the funds of your loan to the title company. Title will confirm the closing day, time and final wire amount for you to bring the remaining if any of your closing costs to closing.

Your Realtor will schedule a final walk through to see make sure the home is still in the same condition and the seller and their belonging are out of the property prior to signing. I will review the final numbers with you.

So, what's left?

Closing Day!

After your final walkthrough of the home you will either wire your remaining closing costs to title or bring a cashiers check and then you will head to your closing with your ID handy so they can verify your identity before signing your mortgage documents.

Be prepared- ALTHOUGH there is an option to sign majority if not all of your documents virtually the title company could still ask you to sign a hefty stack of pages. But don't worry- the closing agent does a terrific job of explaining your documents and if you remember back to your initial documents with Geneva then you have actually already signed majority of these.

And that's it! After you sign on the dotted line you are OFFICIALLY the proud owner of your first home!

OR

maybe a little more info on the Loan Application process will help bring some clarity on what to expect next. Check out the link below!

✨✨✨